Pension awareness week is a five-day event held each year that aims to promote the importance of pensions and provide help and advice through videos and live events.

This year’s pension awareness week is from 11 to 15 September. You can find out more about pension awareness week by visiting the www.pensionawarenessday.com website.

Here at GMPF, we’ll also be getting involved by highlighting some of our resources which are specific to your GMPF pension. We’ll also be posting information on our X (formerly Twitter) and LinkedIn pages.

Day 1 - Overview of the LGPS

To help you understand your Local Government Pension Scheme (LGPS) pension we run online events throughout the year and also have a short information video.

On our page How pensions and the LGPS works, you will also find information on how both a defined benefit scheme (which is what GMPF is) and a defined contribution scheme work.

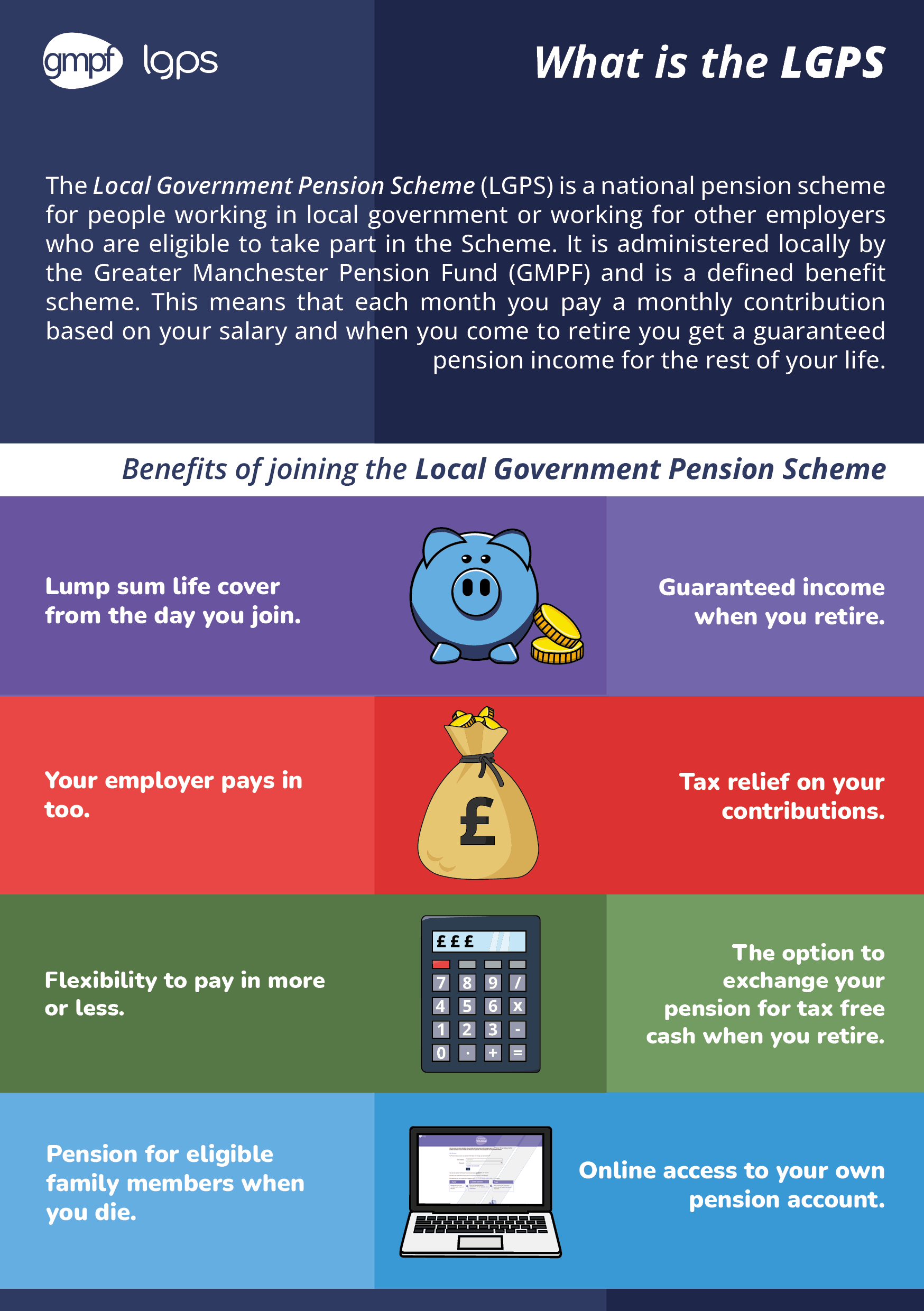

The Local Government Pension Scheme has lots of benefits:

You can find more information throughout our website.

Day 2 - Planning for retirement

It's never too early to start planning your retirement. If you're ready to start thinking about your retirement, visit our Plan your retirement page, which includes a short video from the PLSA about what to think about when planning your retirement, as well as additional tools and websites to provide support.

If you're registered for My Pension you can view your annual benefit statement online which includes your projected pension. You can also run estimates for voluntary retirements using our pension calculator, with different dates and lump sum options.

To help you plan ahead for retirement, visit our Learn more about pensions page to take our quiz, check the Retirement Living Standards, and find links to other useful information.

Day 3 - Learn more about how your pension works

The LGPS is a career average pension scheme. As soon as you begin paying in, you’ll start to build up a pension that we'll pay to you when you retire.

Visit our What benefits you build up page to learn more, including how it's calculated, how you can swap pension for lump sum at retirement, and how revaluation works.

You can learn more about your pension by booking on to one of our events which we run throughout the year, where you can also ask any questions you may have. These events include:

- Take control of your Local Government Pension.

- A presentation for contributing members focusing on how pensions work, the benefits the LGPS provides and how to pay extra into the scheme.

- Pre-retirement.

- A presentation for members currently contributing and thinking about retiring. This includes an overview of the retirement process.

- Topping up your pension - additional pension contributions (APCs) and additional voluntary contributions (AVCs).

- A presentation for contributing members covering the ways you can top up your pension and how to work out your maximum tax free cash.

Day 4 - Nominations and your online My Pension account

From the date you join the Local Government Pension Scheme (LGPS), you get valuable life cover and financial protection for your family. There are two types of benefits we could pay if you die, a dependant's pension and a lump sum death grant.

For more information visit our What death benefits we pay page.

Keeping your expression of wish up to date is important. GMPF decides who to pay your death grant to and we have payment guidelines that help us do this, but we will always try to follow your wishes.

We must consider all relatives and dependants before making our decision so if the person or people you nominate are not your closest family, please consider telling us why.

You can check and change your nomination in your online My Pension account.

You can also update your death grant nomination by calling our Customer Services team on 0161 301 7000 and asking them to post a form to your home address.

As well as updating your nomination, your online My Pension account also allows you to:

- update your personal details

- use a pension calculator to calculate your benefits

- upload documents directly to us

- check your annual benefit statement, or if you're already receiving your pension you can view your P60 and payslips.

Visit our support page for information on how to register, including a short video about the benefits of My Pension.

Day 5 - Pension scams and leaving GMPF

Pension scams can be hard to spot. To help keep your pension safe we've put together guidance on our Pension scams page.

It's also important to be aware of identity fraud. You can read our advice on identity fraud and your GMPF pension on our When and how we pay your pension page.

If you leave the scheme there are a variety of options to choose from depending on how long you've been a member. Visit our What are your options when opting out, leaving or transferring page to find out which options apply to you.