If we pay you an annual pension, you'll receive a P60 on or around your April pay date.

Here are some frequently asked questions about P60s, payslips and Pensions Increase.

What do I need a P60 for?

Your P60 certificate is proof of the tax you have paid on your pension in the financial year. It also confirms the total amount of pension we have paid to you.

You may need your P60 to prove the amount of tax you have paid or confirm the income you have received. For example, this could be if you need to:

- Claim back overpaid tax.

- Apply for tax credits.

- Prove your income when applying for a rental property, loan or mortgage.

We will provide you with a separate P60 for each of your pension accounts.

What does my P60 show?

Your P60:

- Confirms the inflation increase for the year.

- Confirms your new rate of pension for the year and the date that this will be effective, which you can find in the ‘Messages this month’ on your P60.

- Explains why you may not receive the full inflation increase.

- Confirms the tax you have paid on your pension in the tax year (6 April to 5 April). You may need this to prove how much tax you’ve paid on your pension, for example, to claim back overpaid tax or as proof of your income if you apply for a loan or a mortgage.

Where can I find my P60?

We upload your P60 to your My Pension account on or around your April pay date. You can view your payslips and previous P60s in your My Pension account.

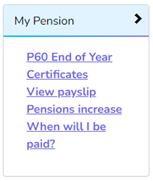

Once you've logged in to your My Pension account, look for the My Pension tile, as shown below, and select either 'P60 End of Year Certificates' or ‘View payslip’. You will open your most recent document when you click on these links.

If you want to view a P60 for an earlier financial year, click once on the year you want to view. You can find a list of the years on the left hand side of the webpage, under the heading 'P60 certificates'.

If you want to view a payslip, click once on the date you want to view. You can find the list of payslips on the left hand side of the webpage, under the heading 'Periods'.

If you have more than one pension account, you can switch between your accounts by using the drop-down arrow in the upper right of the My Pension homepage (next to your ‘status’).

Please visit our Support with my online account webpage for more help.

Why has my pension payment increased? (Pensions Increase)

We increase your pension every April so that it keeps pace with the cost of living.

Local Government and Public Pension Scheme legislation states that we must increase all pensions following the rules set out by the Government. This annual routine is known as Pensions Increase.

The amount we must increase your pension by is based on the Consumer Price Index (CPI) and is normally linked to the CPI rate for the previous September.

Your pension will always increase each year unless the CPI rate that month is zero or below zero. If the CPI rate is sero or below zero, your pension will stay the same and will not go down.

We might also pay you a supplementary pension increase amount if we have paid you a lump sum as part of your benefits during the year. We will pay this extra pension as a lump sum and include it in your payment.

Visit the How your pension keeps pace with inflation webpage for more information.

Why has my pension payment gone down?

If your net pay is lower than last month despite the pension increase, this is probably due to a change to your tax code.

When it comes to tax, there are two things to keep in mind:

1. Personal allowance – this allowance is the income you can have before you pay tax and is currently £12,570 per year. Personal Allowance has not increased in line with inflation like your pension.

2. Your state pension is deducted from your Personal Allowance. So, if for example, your state pension was £6,000 a year, your Personal Allowance would reduce to £6,570.

The state pension has increased this year, which will reduce your Personal Allowance further and may cause a change in the tax code we must apply to your GMPF pension. As your GMPF pension has also increased, this could cause an increase in tax payments or result in you beginning to pay tax. The net total between your state pension and your GMPF pension should, however, be an increase over previous months.

There are other reasons why your tax code might have changed, such as if you have started to receive an additional income (such as another pension or due to a new job) or if your state pension or state benefits have changed.

HMRC sets your tax code, and we cannot change it. You will need to speak to HMRC if you have any queries. You can find the contact details for HMRC and the reference number on your P60.

Why has my pension payment not increased by the full amount?

If you have been receiving your pension for more than twelve months but have not received the full increase, this may be because you have a Guaranteed Minimum Pension (GMP).

If you have reached your State Pension age and were contracted out of the State Pension between 6 April 1978 and 5 April 1997, pensions increase will be split between your GMPF pension and your State Pension.

If you were a member of GMPF between 6 April 1978 and 5 April 1997, you were contracted out of the State Earnings Related Pension Scheme (SERPS) and would have paid less national insurance contributions during that period. Instead, you would have earned a Guaranteed Minimum Pension amount (GMP).

This GMP forms part of your LGPS pension, but the pensions increase due that relates to your GMP is paid between GMPF and your State Pension.

GMPF will only pay the full Pensions Increase if you don’t have a GMP or your State Pension Age is after 5 April 2016.

Why has my pension payment not increased at all?

The Pensions Increase rules do not apply if you have retired on ill health and are under 55, unless the approved doctor has certified that you are too ill to work. We will begin paying pensions increase once you reach age 55.

How can I query the amount of tax that I am paying?

You will need to contact HMRC. You can find the contact details for HMRC and the reference number on your P60. We can only apply the tax codes that HMRC send to us.

*NEW* What does the change from lifetime allowance to lump sum allowance mean for me?

The Government abolished the lifetime allowance (LTA) from 6 April 2024.

Instead, from the same date it introduced a new limit on the maximum amount of tax-free cash you can take from all pension schemes. This limit will be £268,275 or 25 per cent of the value of the pension benefits you are taking, whichever is lower.

This limit is the same as that applied under the lifetime allowance system. If you take further pension benefits in the future, your pension fund or provider will ask you to provide details of any tax free lump sums you have previously taken from your pensions.

If you took tax-free cash with your GMPF pension, we will have paid this as a lump sum when your pension first went into payment. If you need to know your lump sum figure, you can find it on your original retirement documents.

The lump sum allowance will not affect most members as you will not be close to the limits, unless you have built up a large pension. You will only need to know this figure if you still have additional pensions to take.

You can read more about lifetime allowance on our webpage The current pension tax limits.

*NEW* Why isn’t the amount showing on my P60 for my lump sum allowance the actual amount I took as a lump sum with my pension?

The amount shown on your P60 may not match the amount you received as a lump sum when you started receiving your pension.

For most members, this will have no effect on any additional lump sums you can take if you have other pensions as you will not be near to the limit. The limits will usually only affect members who have built up large pensions.

If you took your pension before 6 April 2006, the amount shown will be zero, as the lifetime allowance regulations did not apply at this time. On previous P60s this will have shown as 0 per cent.

If you took your pension between 6 April 2006 and 5 April 2024 then different factors are involved to calculate the figure for your lump sum allowance, depending on when you received your lump sum, and whether you received the maximum amount allowed by the LGPS (25 per cent).

If you took your maximum lump sum allowance from April 2020 onwards, when the standard lifetime allowance was £1,073,100, then the amount on your P60 will be the actual amount of lump sum you received.

If you took less than the maximum amount or took it before April 2020 when the lifetime allowance was a different amount, then the lump sum shown on your P60 will differ from the actual amount of lump sum you received. This is because under HM Treasury rules, we must assume that you took the maximum lump sum allowed, using the lifetime allowance of £1,073,100.

If you took your pension on or after 6 April 2024 the actual amount of lump sum taken will show on your P60.

If you have been issued a transitional tax-free amount certificate by GMPF, then your P60 will show the actual lump sum amount paid.

You can read more about the lump sum allowance on our webpage The current pension tax limits.

How do I get a paper copy of my P60/payslip?

We won’t send you a paper copy unless you have already asked us to do so. If you want to receive future copies of your P60 by post, you must write to us and let us know. Our address is at the bottom of the webpage.

If you also need a paper copy of your most recent P60, please ask us for one when you write to us. You should receive it within two weeks.

We no longer automatically send out payslips, even if you have requested paper communications. If you need a paper copy of your payslip for tax or benefit purposes, you can view and print your payslips via My Pension. Alternatively, please call our Customer Services team on 0161 301 7100.

I have asked previously to receive paper copies of my P60, when will I receive it?

We will usually post your P60 on or near your April pay date. If you’ve not received your P60 within a week or so of this date, please let us know.

The increase to my pension takes me over the limit that allows me to claim benefits. Can I refuse the increase?

No, you cannot refuse Pensions Increase. We must pay Pensions Increase because you are entitled to it under statutory legislation.

Do I need to let you know if I get a job?

Yes. If you get any job with an employer who offers membership in the LGPS, you must tell us, even if you choose not to join the Scheme again. Sometimes working for this type of employer will affect your pension.