Tameside MBC delegates the day to day running of GMPF to a committee called the Pension Fund Management Panel. The panel set up three working groups that consider areas of Greater Manchester Pension Fund’s work in more detail and make recommendations. An Advisory Panel supports the Management Panel and Director of Pensions.

Management Panel

Cllr Eleanor Wills

Tameside

- Chair of the Pension Fund and Executive Leader of Administering Authority (Tameside)

- Chair of Policy and Development Working Group

Cllr Mike Smith

Tameside

- Vice Chair (1st Deputy) of the Pension Fund

- Chair of Investment Monitoring and ESG Working Group

- Administration and Employer Funding Viability Working Group

Cllr Naila Sharif

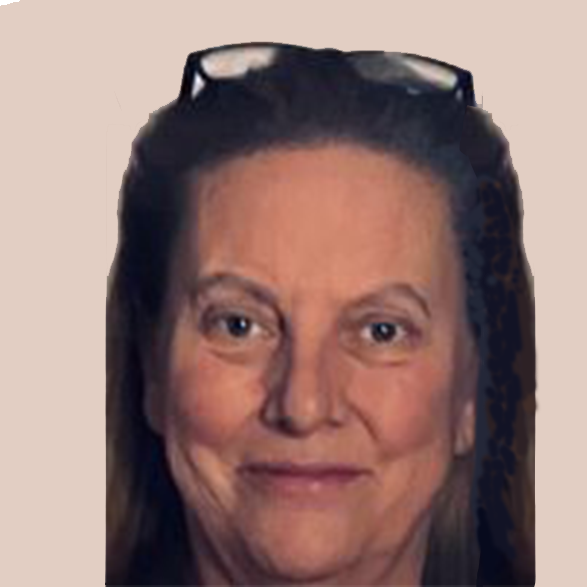

Cllr Naila Sharif

Tameside

- Deputy Chair (2nd Deputy) of the Pension Fund

- Chair of the Administration and Employer Funding Viability Working Group

- Investment Monitoring and ESG Working Group

Cllr Liam Billington

Tameside

- Investment Monitoring and ESG Working Group

Cllr Laura Boyle

Tameside

- Investment Monitoring and ESG Working Group

Cllr Andrew McLaren

Cllr Andrew McLaren

Tameside

- Administration, Employer Funding and Viability Working Group

Cllr John Taylor

Tameside

- Administration and Employer Funding Viability Working Group

Cllr David Mills

Tameside

- Administration and Employer Funding Viability Working Group

Cllr Jack Naylor

Tameside

- Investment Monitoring and ESG Working Group

Cllr Sangita Patel

Tameside

- Administration and Employer Funding Viability Working Group

Cllr Hugh Roderick

Tameside

- Investment Monitoring and ESG Working Group

Cllr Denise Ward

Tameside

- Administration and Employer Funding Viability Working Group

Cllr Nicholas Peel

Bolton

- Administration and Employer Funding Viability Working Group

Cllr Sean Thorpe

Bury

- Administration and Employer Funding Viability Working Group

Cllr Rabnawaz Akbar

Manchester

- Policy and Development Working Group

Cllr Abdul Jabbar

Oldham

- Administration and Employer Funding Viability Working Group

Cllr Peter Hodgkinson

Rochdale

- Policy and Development Working Group

Cllr Jack Youd

Salford

- Investment Monitoring and ESG Working Group

Cllr Jilly Julian

Stockport

- Administration and Employer Funding Viability Working Group

Cllr Joanne Harding

Trafford

- Administration and Employer Funding Viability Working Group

Cllr Nazia Rehman

Wigan

- Investment Monitoring and ESG Working Group

Petula Herbert

Ministry of Justice

- Policy and Development Working Group

Advisory Panel

Employer representatives

Councillor E Wills – Tameside (Chair)

Councillor N Peel- Bolton

Councillor S Thorpe - Bury

Councillor R Akbar - Manchester

Councillor A Jabbar – Oldham

Councillor P Hodgkinson - Rochdale

Councillor J Youd - Salford

Councillor J Julian - Stockport

Councillor J Harding - Trafford

Councillor N Rehman – Wigan

Employee representatives

Ken Drury

Ken Drury

UNITE

- Investment Monitoring and ESG Working Group

Frank Llewellyn

UNITE

- Administration and Employer Funding Viability Working Group

John Thompson

UNITE

- Policy and Development Working Group

Lisa Millar

UNISON

- Administration and Employer Funding Viability Working Group

Scott Caplan

UNISON

- Investment Monitoring and ESG Working Group

Alan Flatley

GMB

- Investment Monitoring and ESG Working Group

- Administration and Employer Funding Viability Working Group

Observers

Councillor John Taylor - Stockport

External advisors

Two external advisors assist the Advisory Panel regarding investment related issues. The advisors are:

P Moizer - Professor and Dean of Business School, University of Leeds

M Powers - Retired Investment Manager

Terms of Reference

The terms of reference for the Management Panel outline its responsibilities, as set out below.

Management Panel responsibilities

The Panel’s specific functions and responsibilities include, but are not limited to, the following:

- Setting the overall strategic direction for the Fund’s activities and establishing priority objectives for the Director of Pensions.

- Approving an annual business plan and monitoring performance against key objectives.

- Setting the terms of reference for the Fund’s Advisory Panel and Working Groups and appointing members to each.

- Appointing independent advisors to advise the Management Panel and independent observers to participate in the Advisory Panel.

- Receiving reports from the Working Groups, Local Pensions Board and Director of Pensions and making decisions taking into account their recommendations.

- Providing guidance to the Director of Pensions and other officers in exercising their delegated powers.

- Approving the allocation of resources and an operational budget for the Fund each year and receiving reports on spending.

- Reviewing and approving all statutory policies of GMPF.

- Ensuring there is an effective system of financial control in place and regular scrutiny of the Fund’s audit plans, the reports prepared by Tameside MBC’s Internal Audit team and those prepared by the External Auditors.

- Ensuring an effective risk management strategy is in place and there is adherence to the Fund’s Risk Management Policy and regular scrutiny of the whole fund risk register.

- Determining the Fund’s investment strategy, responsible investment policy and its core investment beliefs and arranging the management of the Fund’s investments.

- Providing direction to the Northern LGPS and undertaking any functions necessary in relation to it.Monitoring investment activity and performance and taking independent and specialist advice on matters to be determined.

- Determining the Fund’s administration and governance arrangements, overseeing administration activities, performance, and the payment of benefits.

- Assessing employer funding arrangements and approving the funding strategy statement, as well as overseeing the triennial actuarial valuation process.

- Approving the annual report and accounts.

- Monitoring developments within the LGPS and the wider pensions landscape and assessing the impact of these developments on the Fund, together with subsequently setting or amending any related polices or governance arrangements.

- Considering views expressed to the Management Panel by the Local Pension Board, scheme employers, scheme member or pensioner representatives.

- Making representations to the Government about any planned changes to the Local Government Pension Scheme or related legislation, and approving responses to consultations as and when required.

- Approving the training plans for all elected members and officers with delegated responsibilities for the management and administration of the Scheme.

- Promoting equality, diversity, and inclusion, and encouraging all views to be expressed and considered.

- Any other area within the statement of purpose as the Management Panel deems appropriate.